19 Ene The IT role in innovation

Just a few years ago, in western societies the focus for maintaining a competitive advantage was on productivity and quality. These were times when Six Sigma, lean manufacturing and the Theory of Constraints were at their peak. However, is widely acknowledged that innovation has replaced productivity as top concern for maintaining competitiveness in the western world (Aho, 2006).

Nevertheless, our conception of Innovation has changed too, because the process by whom innovation unfolds has changed too. If we take a look at the great invention of the turn of the XIXth century we can in most cases easily recognize the inventor and the company that promoted the invention, many times portrayed in quasi heroic terms. However if we perform the same process with the innovations that characterized the turn of the XXth century, like Internet, digitalization of music, mobile phones, web 2.0 and so on, it will be very difficult, if not impossible, to identify a single inventor or company responsible for its massive adoption. This simple exercise evidences not only the change that has taken place in innovation, but its dimension.

Innovation has been described for a long time as a linear process comprising ideation, conception, design, development and diffusion, and this linear model matches well many innovations of the XIX and XX century, or at least our actual vision of them. However, it fails to accommodate many of the most recent processes, let us mention the Internet as an illustration. Nonetheless, innovation seems nowadays better described as the result of multiple interacting actors and in terms of a complex system where innovation is an emergent result.

Innovation can also be portrayed as a product of the confluence of three spaces. One corresponding to the technological capabilities of a given moment. A second one comprising the business models that enable instrumenting and capturing value from these possibilities. And a third one describing the societal value, hence consumer acceptance, of the product of the last two. The confluence of these three spaces will determine the value of a certain proposition.

A way to describe what has changed in innovation is to use this model to uncover the changes in each one of the three spaces and as we will see, they were significant.

Maybe the most significant change occurred in the technology space. The widespread access to knowledge, fostered by globalization and the Internet made possible the existence of many expert groups and many experts in fields where before knowledge was largely centralized. In addition or as a consequence of that we have assisted to a remarkable amount of technological progress in almost all fields, where many technologies are now of multiple use, producing as a result a huge increase in the number of possible technical solutions that could result of their combination.

But also in the societal space we have witnessed an important mutation in the role of users. From being mere recipients of innovation, playing only a role in selecting among existing proposals, their position has been transformed in being active players and in some cases driving the innovation process. Either as co-creators or innovators themselves as described by von Hippel or in producing content, the role of users has gone beyond selecting among existing proposals to claim a center stage in shaping the innovation process.

Finally the appearance of new business models has also enlarged the possibilities of making innovation viable in the real world. Key contributions have been the ones of Google, IBM, P&G, the Open Source community and the so called iTunes model to mention a few. These new business models have allowed for combinations of technological and societal that couldn’t exist before with more traditional business models.

A consequence of all that, has been the transformation of products in – sometimes open – platforms of hybrids (combinations of physical products and services) with large user involvement and where companies have a fraction of the control that once had in the integrated model.

An icon on these changes is the iPod+iTunes platform often viewed as the quintessential closed product. However, the iPod was originally the idea of an entrepreneur – Tony Fadell – who without success explored the idea first in Philips and RealNetworks to finally come to Apple, therefore it was an idea from the outside. Apple hired a 35 people team from Philips, Ideo, General Magic, Connectix and WebTV to develop the iPod, keeping control of the user interface and design and leaving PortalPlayer in charge of the technical design. The end product the iPod, is the result of a combination of the best technologies of many companies, for the sake of the example, a 30GB Apple fifth generation iPod has more than 400 input different components with an average value of $0.05 each.

This example easily portrays some of the key aspects of the new collaboration trends in innovation: a) putting outside ideas on the same rank as those coming from inside the company, b) leveraging on the strength and innovation capacity of external firms, closely collaborating with internal resources and c) aligning the business model accordingly. Moreover, the iPod is also a good example of user contributed contents (e.g. podcasts or videocasts) and product platform: iPod+iTunes ecosystem.

In fact, in a recent Mckinsey report on the next business technology trends to watch (Manyika et al., 2007) the first group of trends was devoted to managing relationships for innovation, there the Mckinsey report underlines four main trends:

Distributing co-creation. Advances in IT technology made possible to delegate substantial control to outsiders in the creation process, allowing effectively co-creating with partners, outsourcing innovation and working together in networks. If this approach to innovation becomes widely accepted, the impact on both company and societal structure could be substantial. Consumers as innovators. The rise of the involvement of consumers in the innovation process is clear and evident to everybody. Consumers are deeply involved in creating content, co-creating and shaping the innovation process by selecting and backing proposals. However, mechanisms and platforms that could tap into that potential are still, to say the less crude. Tapping in a world of talent. As companies involve themselves into outsourcing innovation and collaborating more deeply with specialists, free agents, universities, users, … they increasingly face the problem of tapping in this universe of talent, locating best options, maintaining relationships and engage with multi-located diverse teams. Extracting value from interactions. Software is increasingly replacing transactional activities that once were the bread and butter of management. As a result, we find leaner companies on one side and on the other, managers involved a very significant amount of time in meetings, negotiations, ad-hoc collaboration, … in other words in tacit interactions. Furthermore, a growing number of tools are been used, such as video-conferencing, blogs, wikis, virtual team and collaborative environments. As companies use these tools, they will develop and apply managerial innovations that could allow them to capture more value from interactions.

Open Innovation (Chesbrough, 2003, 2006) provides the theoretical and methodological skeleton that allows to operationalize this trends.

However, when companies attempt to articulate Open Innovation in practice they are usually confronted with two new problems: a) a large enlargement of the space of solutions with which they have increasing difficulties to cope a massive and b) a massive filtering problem, which companies and which ideas should be pursued and which ones should be discarded. Moreover, the time dimension plays also a role, ideas that look irrelevant or unfeasible now can be the seed of the next revolution.

Selecting relevant objects from an increasingly large space is the type of problem that cannot be tackled only with traditional mechanisms and in which AI has been working since long.

A basic mechanism of innovation is recombination (Schumperter,1934; Hargadon, 2003) and recombination needs diversity and interaction. Again, two aspects where Collaborative Environments could prove to be superior to more traditional settings.

Additionally we witness how social interaction is progressively becoming IT mediated. An example of that is not only the trend on social networking but its spreading in the workplace.

Therefore existing companies on one side and new endeavors on the other are trying to benefit from this new environment by capturing value from it or by providing new intermediation services that could fill the needs of these companies. One of the most salient cases in the first area is P&G while in the other we can find new intermediaries like Innocentive, Yet2Come or Nine Sigma.

The Case of P&G

P&G is maybe the world’s best known consumer business firm. With net sales over $40B (2006) and more than 10,000 employees they operate in almost every country in the world with brands as well known as Ariel, Tide, Pringles or Pampers.

In order to maintain its competiveness, P&G has always extensively relied on R&D, with more than 29,000 patents, 5,000 added on average every year, and with a budget exceeding $5M, P&G certainly is a R&D champion in the sector.

However, even P&G has more than 8,500 researchers and an impressive track record, A.G. Lafley, Chairman of the Board, President and CEO of P&G recognizes that outside the organization the are another 1.5 million researchers with pertinent areas of expertise, and not only that, but other groups such as customers, suppliers and even competitors are sources of innovation that no company can afford to ignore.

This inner belief in the central role of innovation, lead in P&G to start in 2003 the now famous “Connect & Develop “ program. In Dr. Mike Addisson own words: “Innovation is all about making new connections. Most breakthrough innovation is about combining known knowledge in new ways of bringing an idea from one domain to another”.

One of the objectives of the Connect & Develop program was therefore to inject ideas and technologies coming from external partners in at least 50% of P&G projects.

The point of departure of this process could probably be attributed to the “Innovation 2000” expo, with an attendance of over 5,000 internal researchers that together with invited external suppliers resulted in around 2,200 new ideas for new products and new applications for P&G technologies.

However, this process cannot be depicted as only a technological one, a whole array of organizational changes has been supporting P&G transition to Open Innovation, some of them are new proposals, but many correspond to more traditional strategies such as acquisitions and the use of internal seed funds.

IT Support for Innovation at P&G

However, many of the aspects of this innovation push in P&G rely on IT. In fact, two types of technologies have made possible for P&G such an opening in participants and solutions. On one side, Collaborative Environments have made possible the opening to large number of participants. On the other side, simulation, modeling and virtual prototyping help in coping in experimentation with an increasingly large space of solutions (Dogson, 2006).

1. Collaborative Environments

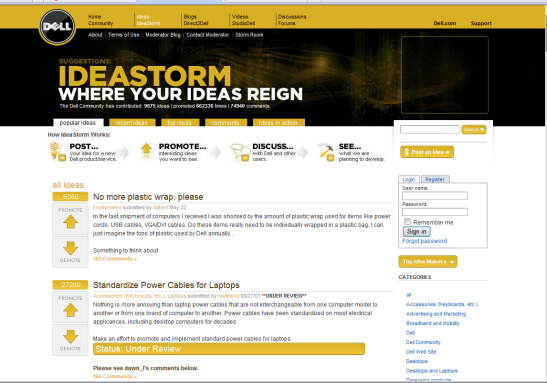

The basic tool for “connecting” people-to-people and people-to-knowledge in P&G is the InnovationNet. Nabil Sakabb, senior Vice-President R&D describes InnovationNet as a “global lunchroom” where researchers can make connections and share data and information from internal and external sources. In 2002 there were 9 million documents in InnovationNet. However, InnovationNet is not just a repository of information, it extensively uses IT technologies and more specifically recommender systems to disseminate information to potentially interested researchers and to connect researchers with new interests, hoping to foster knowledge and cross-fertilization.

Nevertheless, not all mechanisms that P&G uses rely exclusively on technology. An example of that is the “Technology Entrepreneurs Network”, consisting of 70 individuals that act as intermediaries, continuously scanning patent databases, scientific literature, conferences, the Internet, … seeking new products and new technologies that could fit in P&G portfolio. In the three year period of 2003-2006 they have identified more than 10.000 products suitable for P&G.

Additionally, P&G extensively uses Internet- based Innovation intermediaries such as Innocentive, Yet2.com or Nine Sigma, … that we will discuss later on in this article.

2. Simulation, Modeling and Virtual Prototyping

Simulation and Modeling allow exploring solutions virtually without having to invest in actually build a test environment. This obviously results in important savings in terms of time and money, but what is probably more important, allows testing a larger number of potential solutions in the same amount of time. The most obvious use of these type of technologies has been in product development, however these technologies are also useful in innovation.

A good example of its use in P&G was the design of the supply network, where the Global Analytics group extensively employed simulation and modeling to examine manufacturing operation for removing bottlenecks, improving operational deficiencies, testing sequences of operations, etc…

Another example is the use of virtual prototypes for early prototyping. In both, the case of evaluating material’s effectiveness and suitability for manufacturing and in assessing the practical user experience by evaluating how they perform in the hands of customers and how could consumers use the product.

“Create Innovate”, a small group within P&G devoted to packaging has extensively used these techniques.

Innovation Intermediaries

Maybe, the most prominent example of the use of IT in Innovation and especially in Open Innovation, are innovation intermediaries. The majority of existing innovation intermediaries are focused in scouting, looking for technologies and solutions suitable for companies in this vast space of potentially possible solutions that globalization opened.

Moreover, intermediaries solve an additional problem in innovation: disclosure – a variation of Arrow’s Information Paradox. As we have seen, many times Innovation is a result of recombining existing technologies, therefore the disclosure of the technologies involved together with the company interested, could reveal enough information to allow a competitor to easily replicate this information. Intermediaries solve this problem by shielding the company that remains anonymous through the whole transaction.

Innovation intermediaries can be divided mostly in two types: agents and marketplaces. Agents scout and negotiate on behalf of a company, seeking new technologies and new opportunities around. In order to be able to do that agents have to become acquainted with the needs and technologies of their clients, a process that requires a serious involvement.

On the other side, marketplaces face the problem of creating a market thick enough to be viable.

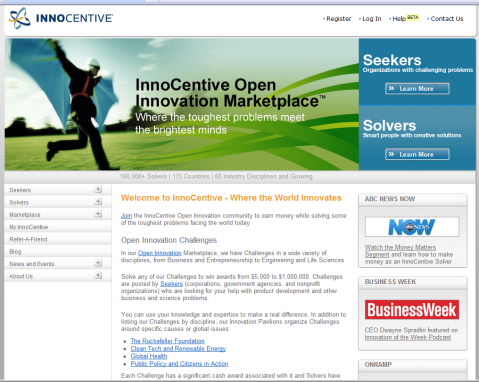

InnoCentive

InnoCentive was a spin-off of the drug maker Eli Lilly. A group in side Lilly felt tha the company should increase its presence and activity in Internet and as a result of that they manage to give birth to e-Lilly. One of the first investments of e-Lilly was InnoCentive, a that time BountyChem.

BountyChem was a result, like many other companies, of both a need and a perception of an opportunity. Lilly had accumulated through the years a number of unaddressed projects that never seemed to find a time slot for the internal R&D organization. On the other side, after Prozac it was a feeling that there was a need for innovative projects that could fill the pipeline and take advantage of the “Prozac effect”. As a result of all that, InnoCentive launched operation in June 2001 with an initial set of chemistry problems that came from Lilly.

InnoCentive insight consisted in leverage on Lilly as a market creator. The initial problems – challenges in InnoCentive terminology – proposed by Lilly will attract potential problem solvers which in turn will make the marketplace more attractive for companies creating that way a virtuous circle.

Two types of challenges find its place in InnoCentive, the so called “paper challenges” that only require a solution proposed on paper and the “wet challenges” which require some kind of demonstration. Awards rank from $5,000 to $10,000 for paper challenges and from $25,000 to $50,000 or more for wet challenges.

An important issue in InnoCentive’s challenges and also a great part of the added value of the company is its ability for shielding the company and the problem. To that extend, InnoCentive staff provides advice to the contracting company on how to write abstracts and how to describe problems in a way that is informative but does not disclose confidential information. This process is supported by legal contracts where InnoCentive represents the real company and where the identity of the solver is known when he qualifies as such. Is only at that point when more information about the problem to solve is provided, after signing a legal agreement between the solver and InnoCentive. Also at that point is when InnoCentive personnel begins to closely collaborate with the external researcher in refining the proposed solution until it meets the criteria for being submitted. After that submission takes place, InnoCentive staff selects the best solution and a payment is made. During all this process the identity of both seeker and solver are unknown to each other, identity that is only revealed after a solution is selected and the award paid. An additional agreements indemnifying both the seeker and InnoCentive in case of false information is signed.

Additionally, an important point is to establish where the solution ends and the internal use of this solution begins. Again InnoCentive provides advice on what should constitute a “solution” that warrants payment.

A key issue in this process is what is the real value of the solution for the seeker and therefore if the whole process is effective compared to the use of internal R&D. Because of its closed relation with Lilly InnoCentive was able to collect data that could bring some light on the issue. Based on 12 challenges posted by Lilly in June 2001 that received 82 solutions from 16 countries during the next year, InnoCentive award and paid $333,500 for them, the cost for Lilly amounted $430,000 while the value of the solutions was estimated on $8,8M. The cost of doing the equivalent work internally would have been $600,000. Therefore the cost-benefit for Lilly yielded a ratio of 20:1.

An important factor in InnoCentive is fostering diversity, because diversity provides different insights due to different approaches and points of view. In this area, InnoCentive has done fairly well, already in 2003 around 40% of solvers came from outside USA and Western Europe. Although this was not only a result of the Internet and globalization, but also forged through signed agreements with leading scientific centers in India, China and Russia, such as India’s CSIR, the Russian Academy of Sciences and the Chinese Academy of Sciences. Also the interest of the authorities in these countries, that saw InnoCentive as a way to retain talent and participate in global R&D fueled this process.

Although its unquestionable success, the weight of seekers and solvers remains pretty skewed on the side of seekers, rather than a more equal distribution traditional of real marketplaces where synergies between buyers and sellers develop creating new opportunities. This is probably the next big challenge for the company.

Prediction Markets

Prediction Markets have been steadily increasing its popularity in the last years. Several events like the continuous success of the Iowa Prediction Market in foreseeing winners in the American elections, books like “The Wisdom of Crowds” or the adoption by high buzz, highly popular firms like Google or HP have contributed to that.

Internet-based prediction markets have emerged as an approach to predict short and medium term market developments. The basic idea is to bring groups of participants together via the Internet and then let them trade shares of virtual stocks. These stocks present a bet or investment on the outcome of future market situations and their value depends on the realisation of these markets situations. Once the outcome of a specific market situation is known, each share of virtual stock receives a cash dividend or payoff according to that specific market outcome.

Prediction markets have operated in various environments with diverse characteristics. We have surveyed a great number of markets and we provide an initial classification based on the work of Ankenbrand (Ankenbrand et al, 2005) that could provide insight to the design of the idea prediction market of this project. Three types of prediction markets are examined; academic experiments, betting exchanges and internal markets, which are mainly used in corporate environments. In the following, we present the four types in more detail accompanied by examples:

Academic Experiments

The goal of prediction markets operating in an academic environment is mainly to research the nature and characteristics of prediction markets as an alternative forecasting tool and their applicability to specific research fields. These markets operate for teaching and research purposes and are therefore non-profit oriented.

The main examples include Anderson School at UCLA (Professor Ely Dahan), University of Passau (Professor Martin Spann), University of Iowa (Professor Thomas Gruca), Ruhr University Bochum (Professor Mario Rese et al), Wharton Business School (Professor Justin Wolfers), University of Mannheim (Dr. Carsten Schmidt).

The focus of academic markets spans from measuring preferences of new product concepts and attributes to predicting actual events, following a variety of approaches, therefore the conducted academic research and experiments cannot be summarized here. Throughout this document, the results from the academia that influence our work on idea prediction markets will be referenced.

Betting Exchanges

Betting exchange platforms differ from online betting-bookmaking since they utilize market mechanisms, mainly double auctions, to offer better quotes for their users.

Two types of such markets exist; betting exchange platforms with the primary goal to earn with the trading activity of the users (Betfair, Bluevex and Trade Exchange Network) and betting exchange platforms with the primary goal to generate data for research purposes (Hollywood Stock Exchange (HSX) and Yahoo! Tech Buzz). These systems cover a broad range of topics concerning sports, financial, political, weather and special events. The main objective of all participants is profit maximization and although in some cases the nature of the placement may be based on a rationale decision, it usually has a strong betting flavor that does not provide significant insight on the prediction of the forecasting goal. Thus, our focus will be put on the latter ones that aim to derive accurate forecasts and insights on participant’s behaviors on a specific set of topics. In particular, HSX focuses on movie and actor issues and Yahoo! Tech Buzz lets the user trade on the popularity of technology concepts, products and trends.

Internal Markets

Internal markets typically operate within a corporate environment. A few examples of internal markets exist in the academic environment such as Iowa Electronic Markets that operate private markets for specific target groups. All of the corporate markets were closed markets and only selected employees could participate, either anonymously or not depending on the case. The strategic objective of these markets is information or resource allocation. In the latter case, Intel has announced the operation of a market with the objective to allocate production capacities using futures contracts.

Hewlett-Packard, Microsoft, Dentsu, Eli Lilly and Siemens are corporations that have operated these kind of prediction markets. The main objective of these existing realizations is to gain a better foresight on specific issues by aggregating users’ information. A more detailed examination and insights from these markets are provided in the following chapter.

Existing prediction markets vary in negotiated topics and forecasting goals. A single market may cover a single or multiple topics, e.g. sport events or weather forecasts. The type of topic has a direct relationship with the forecasting goal of the market and both impact the market design.

The main categories of prediction markets based on their topic are the following:

Political and Economy Markets

Prediction of a clearly defined external event (usually binary), e.g. an election outcome. Prediction of the occurrence or non-occurrence of a particular event, e.g. the withdraw of US troops from Iraq or major legislative developments. Prediction of a future absolute number, e.g. future economic data releases. Prediction of a future relative number, e.g. vote shares of different political parties. Entertainment

Prediction of a future absolute number, e.g. the revenue of a movie in four weeks after its release. Prediction of the point in time when a specific event occurs, e.g. when a movie star will retire. Prediction of a clearly defined external event (usually binary), e.g. who wins the Oscar after the nomination. Sports events

Prediction of a clearly defined external event, e.g. a football game outcome or a tournament winner. Financial Markets

Prediction of a future number at a specific point in time, e.g. the price of a stock at a specific date (e.g. us future market). Prediction of a future number at a specific time interval, e.g. the price of a stock at a specific date (e.g. European future markets). Technology concepts, products and trends

Prediction of a relative number, e.g. the popularity of products in the category of Portable Media Devices. Technology futures. Forecasting in a business environment is usually much more complex. As Spann (Spann et al., 2003) describe, in business environments:

A prediction may involve entirely different ideas who’s e.g. market adoption needs have to be estimated. The information to solve business forecasting problems is usually poorly accessible, whereas, say, political prediction markets are conducted in situations with readily available information. The application of prediction markets for business forecasting problems requires a well-designed incentive structure, because the desired experts might be reluctant to participate and unwilling to invest their own time and money. Predictions related to business forecasting may be required much more frequently to solve recurring problems, for example, idea revisions often need to be evaluated on a monthly basis.

Typical topics in forecasting goals in a corporate environment include: Business events, where the goal is the prediction of specific strategic business event like the outcome of an acquisition or the prediction on the success of a policy or a set of policies e.g. make decisions to abandon a policy that it will lead to poor results or select a policy that it will outperform other proposed policies, see Einbinder (Einbinder, 2006). Market Forecasts, trying to predict the success of a product (Eli Lilly) or just next month sales (HP), this later case has revealed very accurate. Technological Events, where the goal is the prediction of production issues like the number of patches for a piece of software within a period of time or the adoption time of a new software (Microsoft) or the allocation of production capacities for computer chips (Intel) or whether software development projects will meet their schedules (Siemens); etc…

Conclusions

In this brief survey we attempted to provide an overview of the main developments and trends in Collaborative Environments for Innovation and depict the main clues behind them.

Of course, we only covered a few aspects, notably marketplaces and prediction markets. However many other have been left out, mostly Innovation Jams and all the work in creativity/ group creativity covering subjects as diverse as brainstorming and serious games.

As the reader has probably noticed, the field is pretty new and many of the main questions remain unanswered. However, many of them have a singular similarity with established fields in AI, such as distributed search in large solutions spaces, making reliable recommendations that could foster innovation or finding the best characteristics of a group for innovation, in terms of connectivity and diversity, to name a few.

Nevertheless, because interaction is progressively global and mediated though IT, because companies are rapidly embracing Open Innovation and because new forms of connecting and socializing are invading our social life, the locus of innovation is poisoned to change from the R&D departments to open organizations with diffuse boundaries and ultimately the Internet.

In both new loci, existing forms of recombination through real life socialization doesn’t exist anymore, being replaced by new IT mediated forms, where IT in general and AI in particular will certainly make an important contribution and change, once more, the way innovation emerges and develops

References:

Aho, Esko (2006). “Creating an Innovative Europe” . European Commission Report.

Manyika, J.M, Roberts, R.P., Sprague K.L. (2007). “Eight business technology trends to watch” . As seen in McKinsey Quaterly in January 2008.

Sorry, the comment form is closed at this time.