01 Feb The future of carmakers depends on who to collaborate with and how

If there is an industry that represents 20th century, this is arguably the auto industry. But more than a decade and a half into the 21th, a new wave of technologies and innovations is swiftly changing landscape of the automotive business. It happened before, but this time carmakers are in danger of not developing (or controlling) these new technologies themselves, therefore losing their share of value created that they have been used to take.

21st century technology giants such Google, Apple, Amazon, Microsoft or Alibaba have already shown their interest in going beyond their original businesses and dominating some other individual markets. By becoming “hubs” or “platforms” and therefore owning access to billions of consumers, these companies are in a position to create competitive bottlenecks that threat to result in more monopolistic markets.

Competitive structures are transforming from product-driven to network-driven. “Hub economy” is concentrating power on these few companies, making harder for the rest to remain competitive. Of course, it is always possible to react to this kind of competition by using former capabilities or assets in a different way, developing new business models or revenue opportunities, etc. But you can tell that story to former executives of Motorola, Nokia, Palm or Blackberry. Leaders of the mobile phone business not so long ago, now there are out of it while Google and Apple are extracting most of the sector’s value.

Most likely next candidate to disruption

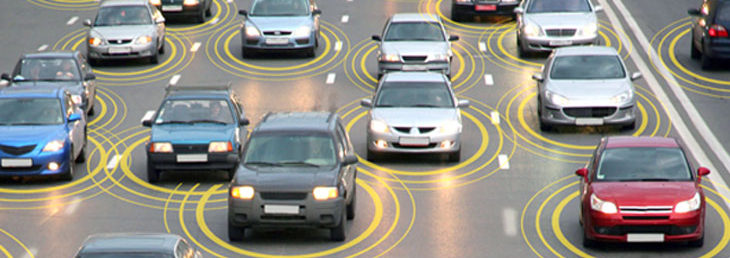

The effect of “hub economy” can be spread to other industries and car manufacturing is a most likely candidate for it. If the future of the car is a connected car, then whoever owns this connectivity will enjoy the benefits of having the upper hand. Connectivity is already reshaping the industry. Consumers in transit are becoming a new source of value. Some car manufacturers have already given Google or Apple access to their dashboards. The potential worth goes beyond the most obvious one, such as the value linked to maps or geo-targeted advertising. It can also include access to markets such as insurance, repairs and maintenance, or mobility and infrastructure services (this is the case, for instance, of the growing demand of car-as-a-service).

Beyond connectivity carmakers should consider other disruptive shifts as electrification and, more importantly, self-driving. For start, the kind of technologies needed to make this kind of vehicles work is quite different to the ones carmakers are used to. Besides, autonomous cars will enable the future driver to spend leisure time while driving. When cars become mainly a living space, companies in this sector will have to change their focus from drivers to passengers. The less important becomes to have somebody in charge behind the wheel, the more important will become as competitive advantage the kind of services offered by cars to improve the experience of moving from A to B, especially if just moving from A to B becomes a commodity.

Are carmakers getting ready to these scenarios? Can they even consider one in which the vehicle itself becomes a commodity? If demand focuses on value outside the automaker’s control, certainly they can not expect to obtain from consumers the kind of “price appreciation” they have been getting so far.

Not alone but, who with?

Car companies cannot conquer the future of mobility alone. Dramatic changes are afoot in the next era of the auto industry. Collaboration across the automotive industry will be critical to address those challenges ahead. But who to collaborate with and how?

Decisions about investments and industry alliances that are being made now will determine the dominant positions of tomorrow. If “sleeping with the enemy” is hard enough, it is even harder to determine for start who the real enemy is actually.

For instance….

More than three years ago, Tesla decided to opening up their patents, considering as “friends” and not enemies any competitor putting electric cars on the market (therefore, helping to move forward faster the new market Tesla wants to thrive in).

A couple of years ago, just the rumors about a collaboration that never happened between Ford and Google for the development of self-driving cars led to plenty of speculation and literature about who (Detroit or Silicon Valley) would become the real winner and the final loser of such a deal.

Two main different approaches to collaboration seem to be considered today by the auto industry. One is about collaborating with the “enemy”, entering into broad-scope collaborative projects with tech companies involving not just shared technology, but also market plans and the co-development of essential technologies. BMW i Ventures, a venture capital fund based in Silicon Valley, or Toyota Connected, a partnership with Microsoft, can be included in this first group.

But these kinds of collaborations also make arise criticism or at least caution among part of the car industry. These critics consider that without proper management, these collaborations could potentially result in fundamental structural changes that might led to further diminution of the carmakers leadership and clout, favoring instead the tech industry. This is why, some other approach to co-innovation considers automotive companies must preserve control over their existing and organically developed technologies in collaborative activities.

Initiatives as the collaborative open source project Automotive Grade Linux, mentioned in this blog three years ago, or the case of Here Technologies, a consortium of Volkswagen, BMW, and Daimler to assemble a “federated” platform providing precision mapping data and location services, are interesting examples of automotive companies once fierce rivals joining together to neutralize the threat of a potential competitive bottleneck controlled by Google or Apple.

Sorry, the comment form is closed at this time.