27 Abr Tech & Insurance will partner to lower premiums to customers connected to the IoT

We have previously discussed in this blog how the so called Internet of Things will disrupt and impact many industries. We have also argued in many posts how the complexity of addressing this and other similar disruptions will demand partnerships and collaborative projects that we would have considered unthinkable just few years ago.

The recent partnership between Roost, a provider of home telematics, and the insurance company Erie (one of one US largest homeowners’ insurers) lead us to consider the question of the many ways IoT can fundamentally impact the insurance market. And with that, of course, the challenges ahead for any player acting in this industry and the kind of collaborations and partnerships these players will need to consider in order to adapt to and survive this disruption.

Insurance industry is already starting to be redefined by IoT, but we don’t usually think about it the way we may think about its impact in automotive, energy or healthcare. Usage-based insurance is one of the more interesting trends in the auto insurance market. Companies have been using telematics that allow providers to offer drivers lower premiums in exchange for safer driving habits.

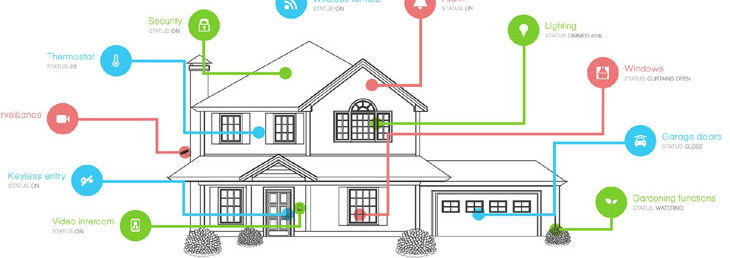

A connected house, a safer home

IoT has the potential to make telematics work effectively outside of the auto insurance industry. Erie Insurance wants usage-based insurance work for homeowners insurance. A costing of $20 billion per year in the U.S should be accounted just considering fire and water perils. The insurance company will use Roost’s home telematics in two areas: water leaks and freeze detection. Roost’s Smart Water Leak and Freeze Detector product connects to a user’s home Wi-Fi network and receives data regularly on measured conditions. The device can trigger an alert to the user’s associated app, helping to catch leaks before they cause significant damage.

A combination of the increasingly prevalent smart and connected sensors and insurance risk assessments would ultimately mean a situation in which insurance companies will be able to easily offer a lower premium to a lower-risk customer. Otherwise, IoT may make difficult for insurers to stay relevant.Customers with houses monitored 24/7 for break-ins or the chance of a fire or flood will start to wonder why to pay a premium similar to those not implementing these risk-lowering technologies.

The partnership between Roost and Erie Insurance is one to watch. Combining Insurance and IoT is all about connecting the insurance sector with clients and their risks. With the emergence of the connected and smart home, players at the home insurance market will soon have to deal with a potentially game-changing feature at their hands. And, as usual, it will be better to deal with this kind of challenges and opportunities with the right (although previously unthinkable) partners.

Tech Company Roost Forms Insurer Partnerships for Home Telematics Pilot

Sorry, the comment form is closed at this time.